Surely the reader will have already come across the situation in which the agreed price for the home you bought differs from the appraisal value that the bank does in a housing loan process. One difference between price and value in real estate is common and normal.

What is the difference between price and value?

I have already written about this topic here at Doctor Finance. The variable price always reflects the amount for which a trade is actually carried out. In practice, it will correspond to the value of the deed. appraisal value assigned by an Independent Expert Appraiser. It results from your analysis and experience regarding the type of property evaluated and its location and must be based on a sufficiently large and homogeneous sample of transactions to allow you to obtain a final result as close as possible to a sale price. But this result it’s still an estimate and, as such, will not be identical to a sale price. Of course, the value variable can have another interpretation. It can represent what, for each one, a certain property is worth. And as real estate, especially residential, has a strong emotional component, the Value perception differs from person to person.Also read: “Buying a house. Is price the most important thing?”

Why does this difference happen?

The truth is that real estate assets bring together a set of characteristics that does not allow them to have both variables identical and have the same value. real estate is non-fungible, illiquid and infrequently traded assets.In addition, they are traded “off-market”, meaning that the formation of the price is agreed through a private negotiation and not in a regulated, supervised and quoted market as is the case, for example, of shares listed on the stock exchange. Therefore, there is naturally a disparity between the values recorded in the price and in the value (of the valuation, for example). The reader will have already encountered this situation in the process of applying for a housing loan for the purchase of own and permanent housing. The bank values the house for a certain amount, different from the price agreed for its purchase.

What is the difference between the variables?

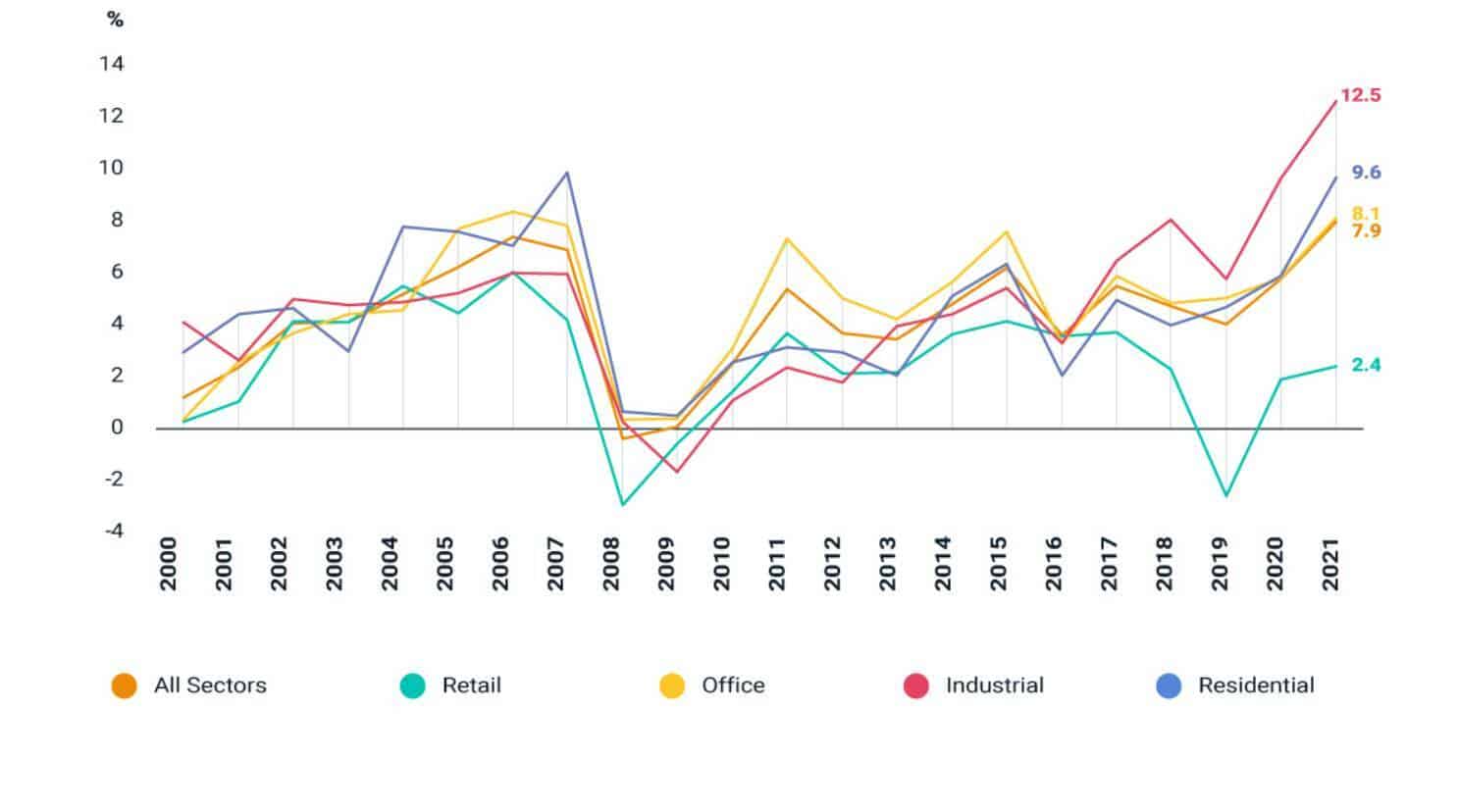

This topic is (again) by the way, the result of an interesting research produced by MSCI a few weeks ago. In this work, the company compiled a historical differential between price and value of real estate assets in different market segments. residential. The strong pressure felt in recent times, on the demand side, in both segments, caused a rise in prices above the historical level, thus leading to an increase in the differential in relation to the valuation values. price and value, referring to properties transacted on the market, increased more than the average of the last 10 years. And looking at historywhenever we see a more accentuated deviation, the market tends to correct in the following periods. Source: MSCIBons business (real estate)! Also read: Real Estate: Sell everything while you can Gonçalo Nascimento Rodrigues is a Real Estate Finance Consultant, having worked in companies such as Ernst & Young, Colliers International and Essentia. He is Coordinator and Lecturer in a Postgraduate Program in Real Estate Investments at ISCTE Executive Education. Additionally, he performs consultancy activities, providing advisory services to real estate investment. He holds a master’s degree in Real Estate Management and Finance and a master’s degree in Finance, both from ISCTE Business School, as well as a degree in Business Management from Universidade Católica Portuguesa. He is the author of the Out of the Box blog. Tags #houses, #Home loan, #real estate

Source: MSCIBons business (real estate)! Also read: Real Estate: Sell everything while you can Gonçalo Nascimento Rodrigues is a Real Estate Finance Consultant, having worked in companies such as Ernst & Young, Colliers International and Essentia. He is Coordinator and Lecturer in a Postgraduate Program in Real Estate Investments at ISCTE Executive Education. Additionally, he performs consultancy activities, providing advisory services to real estate investment. He holds a master’s degree in Real Estate Management and Finance and a master’s degree in Finance, both from ISCTE Business School, as well as a degree in Business Management from Universidade Católica Portuguesa. He is the author of the Out of the Box blog. Tags #houses, #Home loan, #real estate