The year 2022 was marked by the return (in force) of inflation, something that we had not seen in the 21st century. The phenomenon of generalized price increases – inflation – was the reflection of the various crises that we have had over the last few years, with emphasis on Covid-19, which forced the competent authorities (States and monetary authorities) to take measures that made it possible to “create a bridge” between the confinements and the reopening of economies. These measures, for the most part, by injections of liquidity into the real economy, through asset purchase programs and reduction of reference rates, which made “money cheaper”. There was another event that contributed to make the year 2022 more complex. THE Russia’s invasion of Ukraine created yet another focus of instability, and in this case, its real dimension goes beyond the economic aspect, since it calls into question stability in Europe and requires a strategic positioning of the different world powers, which often have opposing interests. The fact that they are two nations with great energy importance also had a important influence on the rise of inflation.Also read: ECB gives bitter gift to families and investors. Interest far from peak

end as it began

December was a very volatile month. As a rule, liquidity is always lower in the last month of the year. Investors’ focus remained on the central bank meetings and on the guidelines they gave us. The financial markets are waiting with great anticipation for the moment when the monetary authorities will announce the end of interest rate hikes, and there were no signs pointing in that direction at the meetings that took place in December. On the contrary, the message that was passed was a fierce fight against inflation.Another factor that influenced the performance in December was the withdrawal of the zero Covid strategy in China, which led to a large increase in cases and hospitalizations. Taking these developments into account, many States have returned to demanding tests for travelers from China.Read more: ECB raises interest rates again and warns that increases will continue

portfolio performance

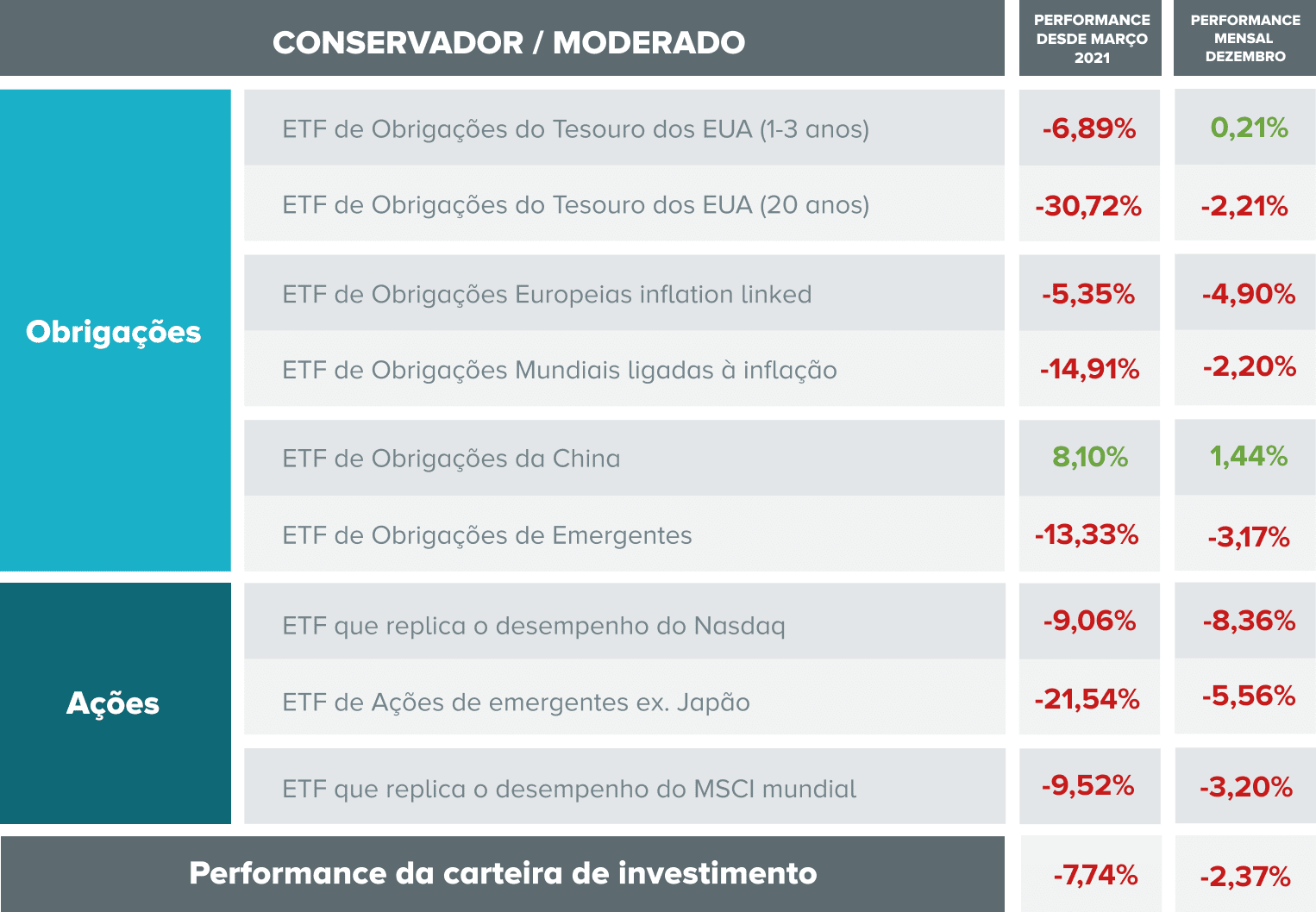

The month was bad for practically all the lines of our portfolios, with the exception of exposure to Chinese bonds and short-term treasuries. THE shareholder segment was the most penalized, due to the fact that investors are positioning themselves for a first semester of enormous uncertainty. With a possible recession on the horizon, no one can anticipate the dimension (great or not intense?) that it may present. At the same time, investors are wary of repercussions that a recession may have on the world economy and, consequently, in the reduction of revenues and valuation of the companies. In short, the December performance was the reflection of the year, where we had negative 10 months. Thus, the moderate portfolio devalued -2.37% and the dynamic -2.6%. Also read: 10 numbers (and graphs) that mark the worst year in the markets since 2008

Portfolio performance with moderate profile

Portfolio composition with moderate profile

Portfolio performance with dynamic profile

Portfolio composition with dynamic profile

Purpose of our portfolios

When, in March 2021, we created these two virtual wallets, our objective was always to knowing how to explain market movements and the influence they had on our portfolios. We have always had this concern, not least because investment is a process that extends over time. As an example, in May 2021, we reduced risk in portfolios as we understand that the performance of financial markets did not have a logical or rational justification. It took some time, but the reality is that our current positioning, despite presenting a negative performance, is better than the initial portfolio. volatility. the fundamental is to understand where we are invested and why. Realizing that in the midst of panic there are always opportunities, and having the rationality to distinguish and find quality assets. Because these, when everything calms down, will recover and generate returns…note: The Doctor Finance portfolios are not and should not be understood as advice to invest in this or that type of financial instrument. Our portfolios were created only to illustrate the potential risks and benefits of investing, directly or indirectly, in financial instruments such as stocks and bonds.