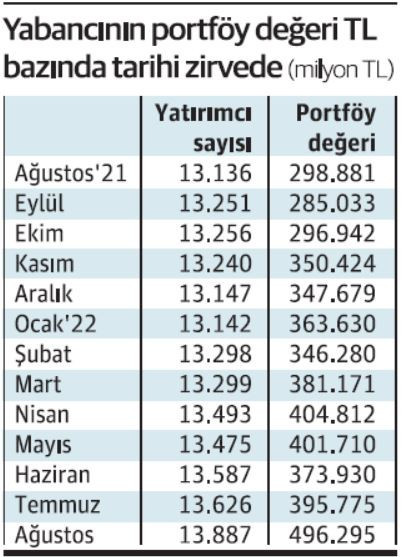

Sebnem TURHAN The month of August was different for the foreign investor who has been exiting the Turkish stock market uninterruptedly in recent years. According to the data of the Central Registry Agency (MKK), the foreign investor, which also shows itself in the banking index, which is mostly preferred by foreign investors, increased its portfolio size to 496 billion 295 million liras in August. This figure, which points to a record level in TL terms, reveals an increase of 100.5 million TL compared to July. The banking index also made a monthly premium of over 50 percent in August. The rise in the banking index continued yesterday. According to Central Registry Agency data, the portfolio value of foreign investors increased to 496 billion 295 million TL in August, compared to 395 billion 775 million TL in July. The number of foreign investors increased from 13,625 in July to 13,887 in August. However, in the last week of August, foreign investors sold shares after 3 weeks. Uninterrupted stock purchases by foreign investors since the week of July 29 were interrupted as of August 26. According to Central Bank data, foreign investors sold 32 million dollars of stocks, 5.9 million dollars of government domestic debt securities and 1.8 million dollars of corporate debt securities in the week of August 26. Thus, the 3-week purchase of the stock by foreign investors came to an end. In the week when foreigners were sellers, Borsa Istanbul BIST100 index gained 4.17 percent weekly, while the 2-year benchmark bond yield decreased by 296 basis points.

Year-to-date output of $2.8 billion

Accordingly, since the beginning of the year, foreign investors have sold a total of 2 billion 886.4 million dollars of stocks, 1 billion 897.5 million dollars of GDBS and 7.8 million dollars of SBS. Foreign investors sold a total of 4 billion 791.7 million dollars of securities in 2022. In the last 1 year, foreign investors made an exit of 5 billion 696.7 million dollars from the securities market by selling 2 billion 955.8 million dollars of stocks, 2 billion 731.9 million dollars of GDBS and 9 million dollars of SBS sales. While the share of foreigners in the stock market was 35.1% as of August 26, this ratio decreased to 33.81 percent as of September 2. This rate, which was 40.6 percent at the close of 2021, was 42.4 percent one year ago.

MKK Profit Index rose 197% YoY in Q2

The Central Registry Agency (MKK) published the 2nd quarter MKK Profit and MKK Turnover Indices, Periodic Financial Ratios and 2016-2022 Average Financial Ratios data for companies traded in Borsa Istanbul. According to the statement made by MKK, the indices calculated using the financial data published on the Public Disclosure Platform (KAP) of the companies traded in Borsa Istanbul are calculated on a nominal basis, based on the sum of the last one-year profits/returns for each quarter. In this context, MKK Profit Index increased by 41.69 percent compared to the previous quarter and by 196.72 percent compared to the same period of the previous year. As of the second quarter, the MKK Turnover Index increased by 29.26 percent compared to the previous quarter and by 113.39 percent compared to the same period of the previous year.