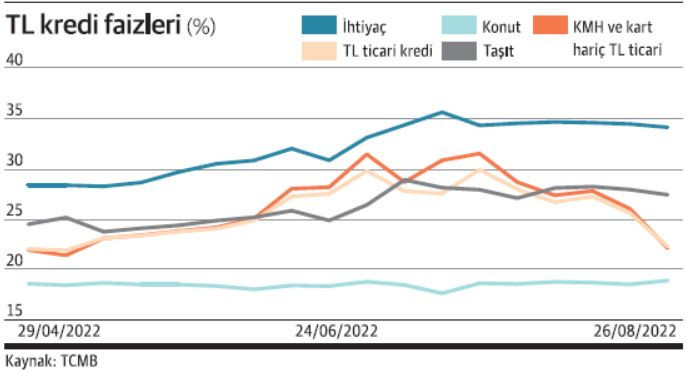

Sebnem TURHAN After the Central Bank’s 100 basis point cut in the policy rate and then the additional security purchase requirement for TL commercial loan interest, TL commercial loan interest rates, excluding KMH and corporate credit cards, were 21.98 percent, the lowest since the first week of May, in the week of 26 August. down to the level. Commercial loan rates decreased by 556 basis points compared to after the August MPC and by 935 basis points compared to after the July MPC. After the monetary tightening brought by successive macroprudential measures, TL commercial loan rates entered an upward trend as of May. During the week of July 22, TL commercial loan interests reached 31.33 percent, excluding KMH and corporate credit cards. The Central Bank drew attention to the gap between commercial loan rates and policy rates and said that steps would be taken to reduce it. Then, in the MPC on 18 August, the policy rate was reduced by 100 basis points to 13 percent. After that, the CBRT changed the 20 percent required reserve requirement in commercial loans to 30 percent security facility on 19 August. In addition, 20 percent of the loans to be extended with an annual compound interest rate of 1.4 times the compound annual reference rate published by the Central Bank, and 90 percent of the loans to be extended with an interest rate of 1.8 times more, have decided to establish securities. According to calculations, banks whose TL commercial loan interest exceeds 22.85 – 29.38 percent will hold additional securities.

Average 27.64% before the MPC

The banking sector actually started to withdraw interest rates after the July MPC, but the decline accelerated with the last step. In the first week after the MPC, TL commercial loan interest rates, excluding KMH and corporate credit cards, decreased from 27.64 percent to 25.87 percent, and fell to 21.98 percent on 26 August. After the MPC, TL commercial loan rates decreased by 566 basis points. TL commercial loan interests, including KMH and corporate credit cards, decreased to 22.15 percent on 26 August. Again, it fell 495 basis points from 27.10 percent before the MPC. According to the Central Bank data, the average TL commercial loan interest rates fell below the obligation to hold additional securities. On the other hand, the loss of momentum in TL commercial loan growth continues. According to Central Bank data, commercial loans, excluding corporate credit cards, grew by 24.97 percent in the week of August 26, adjusted for the 13-week annualized exchange rate effect. Total loan growth was 32.27 percent. In addition to TL commercial loan rates, consumer loan rates, excluding housing, decreased in the week of August 26. While the TL consumer loan interest rate decreased from 34.25 percent to 33.92 percent, the vehicle loan interest rate decreased from 27.77 percent to 27.26 percent. Housing loan interest rates increased from 18.42 percent to 18.79 percent. Total TL deposit interest also decreased to 16.31 percent from 17.32 percent before the MPC.