As a rule, August is a month marked by reduced liquidity in the financial markets. As it is a month typically associated with vacations, many investors end up having a calmer posture in this periodreflected in transactions that are carried out at a global level.

Jackson Hole Symposium

Despite the lower activity that tends to occur in this period, at the end of August there is an event of enormous importance for the financial markets and economy. The Jackson Hole Symposium is an event that brings together different personalities with economic influence, with the objective of debate about where the global economy is headinganalyzing the risks we face, as well as the opportunities. Among all the guests, the speech that generates the greatest expectations is that of the president of the American Federal Reserve (FED), who conveys this institution’s vision for the economy and which monetary policy it will follow, taking into account the economic context and prospects. This year was no exception. In his speech, Jerome Powell reaffirmed the importance of fighting inflation, stressing that this is the great “fight” that the FED is fighting. The levels of price increases that we are going through generate a huge instability in the economywith the loss of real purchasing power and the implications that this fact has on the development of different world economies. Read also: Central Banks: Chasing losses

Strengthening the way forward

When many expected the speech to be calmer, Powell reaffirmed the focus that all FED members have right now. Interest rate hikes will continue to be a realityeven if this implies a period of recession in the short term. Naturally, this strengthening of position was reflected in the financial markets, with bonds “suffering” considerable drops and with the dollar strengthening. Equity markets also showed a significant correction, taking away the gains that had been achieved throughout the month. Jerome Powell’s consistent reinforcement of the path followed by the vast majority of Central Banks lowered investors’ expectations, who had hoped that the Fed’s chairman would have a softer speech. The perception that the context continues to be challenging and that we still have many obstacles ahead, made many investors come back to reality.Also read: Inflation and stagflation: causes and consequences

investment portfolios

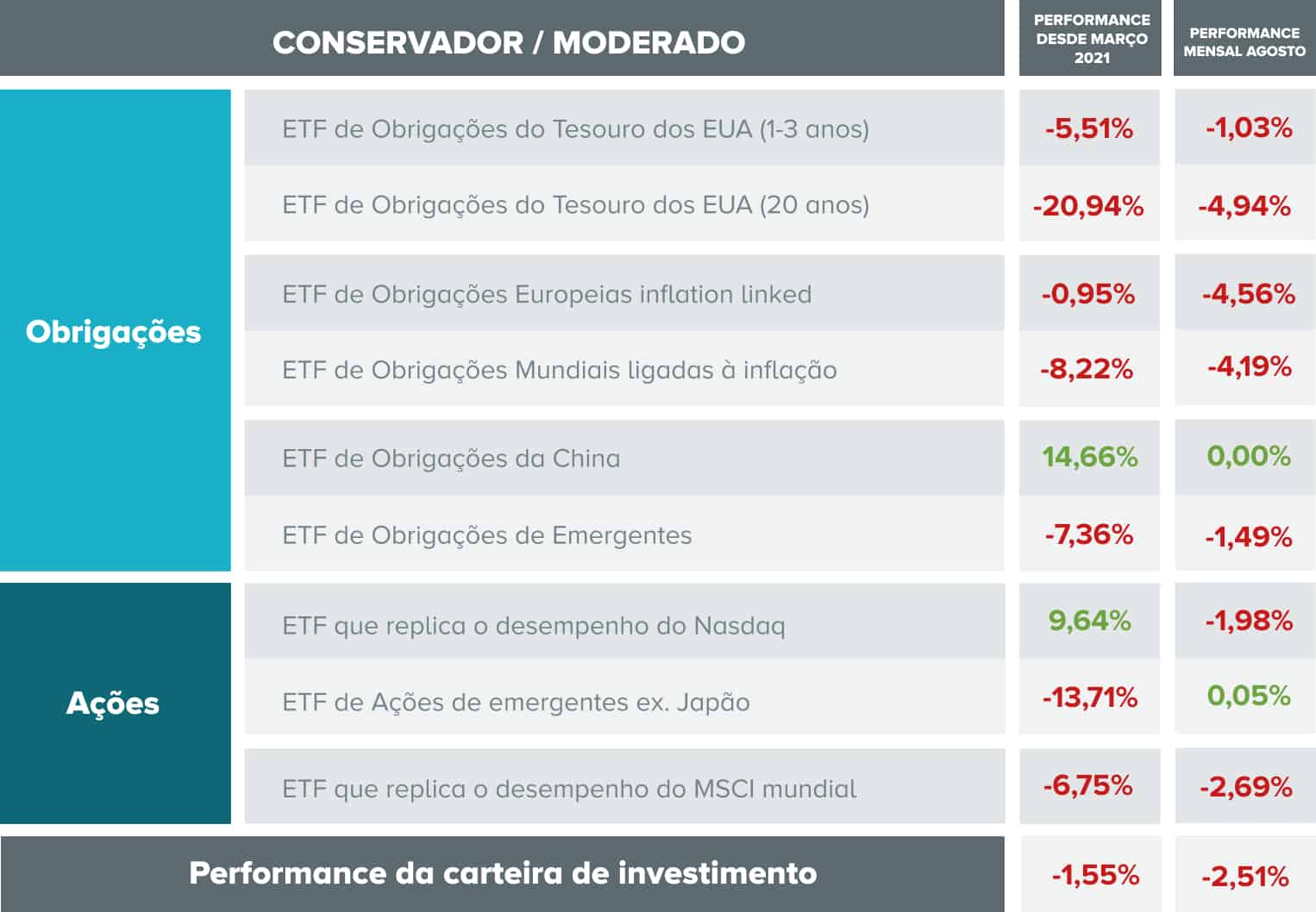

As a reflection of the month, the portfolios presented negative performances. The one that corrected the most was the one with a moderate profile, which is justified by the fact that it has greater exposure to the bond segment, which was heavily penalized by the signaling of a continued rise in interest rates.The equity market also did not have a good return, despite having had a better performance than the bond segment. The appreciation of the dollar was also an important fact that contributed positivelysince we have some assets in dollars in our portfolio.

Portfolio performance with moderate profile

note: The returns presented do not take into account costs and taxes, namely custody fees and transaction costs. Net returns would always be lower than the gross returns presented.The composition of the portfolio with a moderate profile

note: The returns presented do not take into account costs and taxes, namely custody fees and transaction costs. Net returns would always be lower than the gross returns presented.The composition of the portfolio with a moderate profile

Portfolio performance with dynamic profile

note: The returns presented do not take into account costs and taxes, namely custody fees and transaction costs. Net returns would always be lower than the gross returns presented.The composition of the portfolio with dynamic profile Also read: The basics of investing

note: The returns presented do not take into account costs and taxes, namely custody fees and transaction costs. Net returns would always be lower than the gross returns presented.The composition of the portfolio with dynamic profile Also read: The basics of investing

initial objective

Much more than analyzing the performance of the assets that make up the portfolios we have created, our goal is always to explain what is happening and why the portfolios go up or down. If you analyze the evolution of the portfolios, you will notice that there were times when we were up 4/5% and we say that it was a moment of euphoria, since there was no economic basis that supported such valuation.The path that portfolios have been following is an excellent example for those who want to start the investment/savings “journey”. It is essential to have the perception that markets are dynamic, that investments are not made for the short term, that the journey will be turbulent at times and peaceful at others.but above all it has to be a well-defined investment strategy and rationale.note: Doctor Finance’s portfolios are not and should not be understood as advice to invest in this or that type of financial instrument. Our portfolios were created solely to illustrate the potential risks and benefits of investing, directly or indirectly, in financial instruments such as shares and bonds. Review the evolution of the portfolio in the last year View all